11 December 2025

Milan, 10 December 2025 – The latest edition of the CFA Italy Radiocor Financial Business Survey, conducted by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor between 19 and 30 November 2025, reveals a marked improvement in analysts’ macroeconomic sentiment for Italy ,even though the overall index remains in negative territory.

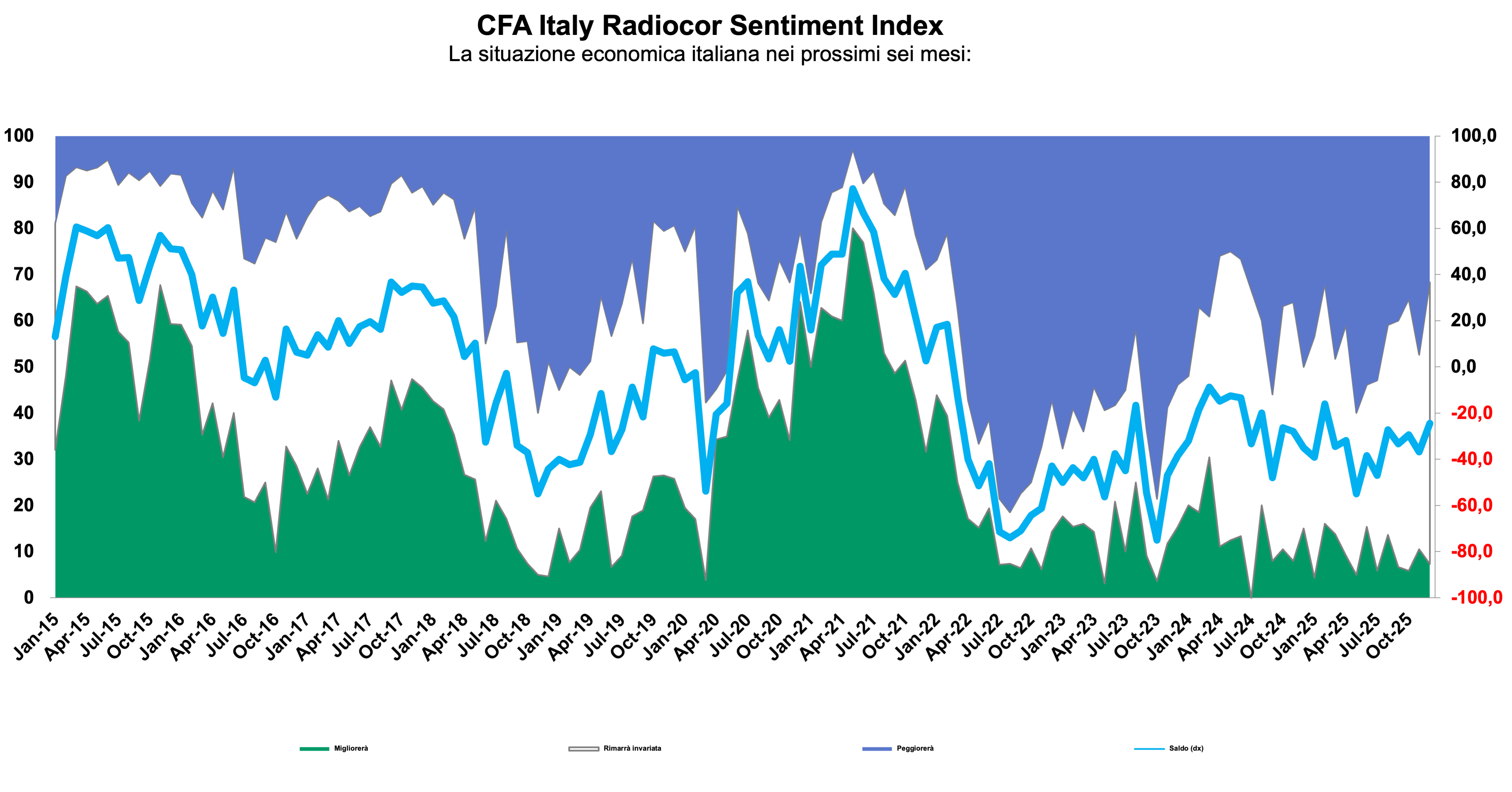

The CFA Italy Radiocor Sentiment Index climbed to -24.4 in December, up 12.5 points from the previous month. This is the most substantial improvement in recent months, primarily driven by a sharp rise in respondents forecasting macroeconomic stability over the next six months (now 61%, +18.9 points). The proportion of pessimists dropped significantly to 31.7% (–15.7 points), while optimists slightly declined to 7.3% (–3.2 points). Despite this modest drop in optimism, the overall mood has clearly shifted toward cautious confidence.

Broader Outlook: Eurozone Stable, US Still Lagging

The outlook for the Eurozone remains broadly in line with that for Italy, showing continued stability. However, sentiment toward the United States remains negative, influenced by a weakened labor market and uncertainty surrounding the Federal Reserve’s leadership transition.

Inflation Expectations Cool in Europe

For the first time in three years, analysts anticipate a potential decline in inflation in both Italy and the Eurozone. In contrast, inflationary pressures are expected to remain elevated in the United States.

Interest Rates: Cuts Expected, but Long-Term Yields Still High

A broad consensus remains around interest rate cuts in the next six months, particularly from the US Federal Reserve. Nevertheless, long-term yields are not expected to fall: growing public deficits are keeping upward pressure on long-dated government bonds, reinforcing expectations of a steepening yield curve.

Equities and FX: Caution After Highs, Dollar Weakness Subsides

Equity market sentiment remains cautious after recent global highs, with many analysts predicting a moderate correction in US markets deemed overvalued. On the currency front, expectations for further dollar weakening have moderated, with the consensus shifting toward stability. Meanwhile, the yen is expected to strengthen against the euro, supported by a potentially more hawkish stance from the Bank of Japan.

Oil Markets: Stabilization Expected

Analysts foresee stable oil prices over the next six months, following a year of gradual declines due to increased output by OPEC+ countries.

Expert View: 2026 Could Extend the Bull Market

Commenting on the results, Aniello Pennacchio, CFA, Deputy Country Head Italy at DPAM, noted:

“We expect the bull market to continue into 2026, supported by strong US earnings momentum and a resilient global macro backdrop. While US labor data are being distorted by migration flows, a stable unemployment rate and rising temporary employment suggest a potential upward trend. This resilience gives the Fed time to react and reduces the risk of policy errors.

Inflation in the US persists for now due to tariff-related cost pass-through, but this is likely temporary and partly offset by falling housing rents. In Europe, low energy prices, a weaker dollar, and Chinese import competition should help keep inflation in check. Overall, we see this as a constructive environment for risk assets, and view any market pullbacks as potential buying opportunities.”

The December sentiment report offers a notable inflection point for CFA charterholders and financial professionals. The emerging signs of stabilizing inflation in Italy and Europe, coupled with improving sentiment and continued caution in equity markets, provide critical context for portfolio positioning and client communications. For members engaged in asset management, wealth advisory, or macroeconomic analysis, the evolving expectations around rates, inflation, and market risk may offer both strategic insight and tactical opportunity heading into 2026.

The Survey appeared in several news outlets such as BorsaItaliana, lamiafinanza, and BusinessCommunity.

The full analysis can be found here, while the relative press release can be downloaded here.