04 February 2026

Milan, 2 February 2026 – Confidence among Italian financial professionals continues to rise, with sentiment reaching its highest point in nearly four years at -3.4,This is the key takeaway from the latest monthly survey conducted by CFA Society Italy in collaboration with Il Sole 24 Ore Radiocor, based on responses collected between 19 and 31 January 2026 from CFA Society Italy members.

The current macroeconomic outlook is perceived as largely stable: over 70% of respondents assess Italy’s economic situation as steady, while approximately 10% consider it positive. A similar view prevails for the euro area and the United States, where macro conditions are also seen as broadly balanced.

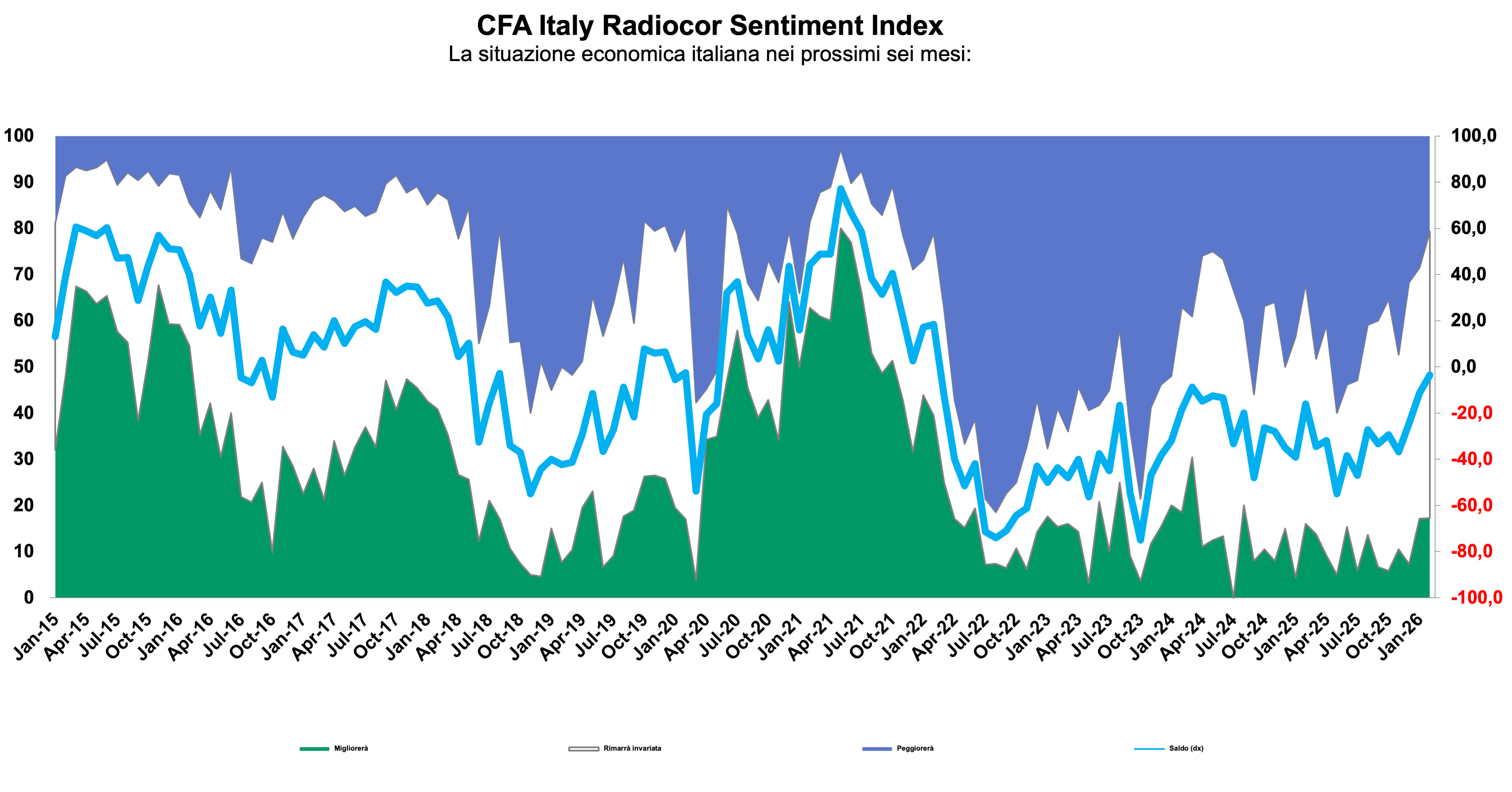

Looking ahead to the next six months, confidence in Italy shows further improvement. The share of financial analysts expecting better macroeconomic conditions rises slightly to 17.2% (+0.1 percentage points vs. January), while those forecasting stability increase to 62.1% (+7.8 points). Meanwhile, the share of pessimists drops to 20.7% (-7.9 points). This results in a net sentiment of -3.4, defining the CFA Society Italy – Radiocor Sentiment Index for February 2026. The figure reflects an 8-point improvement over January and brings the index back to levels not seen since March 2022 - a clear sign of renewed confidence among market professionals.

Expectations for the European economy are also improving, while outlooks for the United States are showing signs of moderation after several months of upward revisions.

On the inflation front, analysts anticipate price stability in Europe, following a long period of disinflation expectations. In contrast, concerns persist over potential inflationary pressures in the US, where consumer prices are still seen as a source of risk.

From a monetary policy perspective, there is broad consensus that short-term rates in Europe will remain unchanged in the coming months, following the latest ECB meeting. In the US, however, the Federal Reserve is expected to cut interest rates, particularly as the leadership transition from Jerome Powell to economist Kevin Warsh approaches. This shift could lead to a decline in short-term yields.

At the long end of the yield curve, financial professionals expect stability or moderate increases, reflecting continued vigilance over public debt sustainability and expectations of persistently steep yield curves.

Equity markets are also seeing brighter prospects, especially in Europe, where analysts anticipate further gains after a period of caution. In contrast, sentiment towards Wall Street remains more restrained, likely reflecting a desire for greater geographic diversification following the US market’s strong outperformance in recent years.

In the foreign exchange market, the prevailing scenario continues to be one of dollar weakening against the euro and yen appreciation, driven by divergent monetary policy expectations.

Lastly, views on the oil market have shifted back to a neutral stance, following a year of predominantly bearish expectations on crude prices.